Not all policies cover all added costs, however. Some make use of a coinsurance design. In this scenario, the insurance firm pays a percent of costs 80% or 90%. Because instance, you would require to pay the remaining balance, 10% to 20% of the costs making use of the example over. Typical sorts of medical insurance plan deductibles include: Prescriptions.

affordable auto insurance risks cars business insurance

affordable auto insurance risks cars business insurance

If you obtain care from a health and wellness professional or medical facility that's not consisted of in your insurance provider's network of approved service providers, you might have to satisfy a separate, out-of-network deductible, as well as that one can be higher than for in-network care. There are a pair of different ways business deal with household health insurance policy plans.

This is recognized as an aggregate insurance deductible. Various other insurers enforce what's referred to as an embedded deductible, wherein each participant of your family members must meet a collection limitation prior to insurance relates to their care (insurers). Frequently asked questions, What is the difference in between an insurance policy premium and also a deductible? A premium is the expense of your insurance policy protection.

The group does not maintain examples, presents, or fundings of products or services we review - auto. In enhancement, we keep a different service team that has no influence over our methodology or referrals - low-cost auto insurance.

Get This Report on Should I Raise My Auto Insurance Deductible? - Coverage.com

You are in charge of the very first $1,000 of damages and also your insurance provider is responsible for the other $1,000 of covered problems. Accident and also detailed are the 2 most common protections with a deductible. Crash-- this insurance coverage assists spend for damage to your car if it hits an additional automobile or item or is struck by one more automobile - trucks.

There are no deductibles for obligation insurance coverage, the coverage that pays the other person when you trigger a mishap - risks. Car insurance coverage deductibles use to each mishap you're in. cheap.

What is an Automobile Insurance Coverage Deductible? Your auto insurance coverage deductible is the quantity you'll be responsible for paying in the direction of the prices due to a loss prior to your insurance coverage pays.

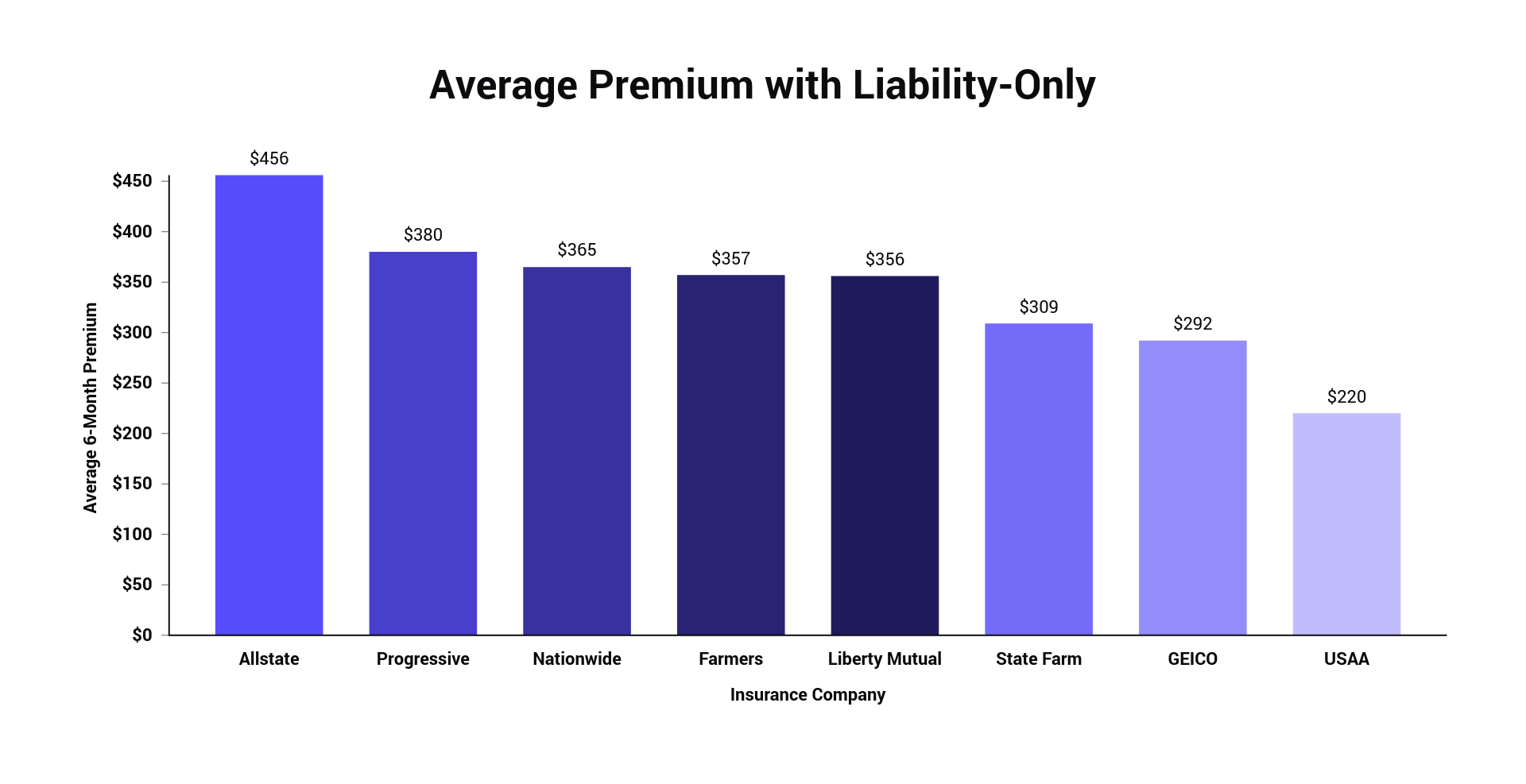

Selecting a greater deductible may decrease your auto insurance policy premium. It is important to choose a deductible you can pay for in the occasion of a loss. Talk with your local independent representative or Travelers depictive concerning the deductible alternatives available to you. When Do You Pay an Auto Insurance Policy Deductible? Anytime you most likely to your very own insurance company to sue for damage to your protected automobile, an insurance deductible will use whether you are at mistake or not.

The Facts About Deductible For Car Insurance - Plymouth Rock Uncovered

What Are Obligation Limits as well as How Do They Function? Your car insurance policy liability coverage restrictions, additionally referred to as restriction of liability, are the most your insurance policy will certainly pay to another celebration if you are legitimately responsible for an accident. Umbrella policies are not needed and also offered insurance coverage limits and also qualification demands may differ by state.

The typical car insurance policy deductible is the ordinary amount drivers pay in advance when they need to submit a case with their car insurance policy companies. After you pay this quantity, the insurance policy company covers the price of the qualifying damage or loss. Visit the website Choosing an auto insurance deductible can have major financial implications, so it is essential to weigh the numerous alternatives with the aid of an insurance agent to make the right selection for you as well as your household.

cheaper cars insurance vehicle low cost auto

cheaper cars insurance vehicle low cost auto

cheapest cheaper auto insurance vehicle insurance vehicle insurance

When you choose a greater insurance deductible for your policy, you will pay a reduced premium for protection (insurance). Wallet, Hub notes that you can conserve regarding 6 percent by selecting a $2000 insurance deductible rather than a $1000 insurance deductible, which might or might not make good sense relying on the price of your policy.

Our Car Insurance Deductibles Guide: 5 Key Things To Know In 2022 Ideas

If you have substantial cost savings, you could favor to have a lower insurance deductible and slightly higher monthly settlement to stay clear of needing to come up with a larger sum in the occasion of an accident claim. The Balance blog keeps in mind that you must also consider your probability of having an insurance claim.

In these circumstances and various other high-risk scenarios, you need to consider selecting a reduced insurance deductible. Low-risk vehicle drivers who rarely file cases may be much more comfortable with high-deductible plans - cheap car. When buying an auto insurance plan, ask each representative to supply you quotes with numerous deductibles. If you would certainly not have the ability to recoup the price of your deductible within 3 years of a claim with the reduced costs, take into consideration picking a lower insurance deductible plan.

credit prices insured car car insurance

credit prices insured car car insurance

In a scenario where you do not have the cash to settle your deductible to a mechanic, the insurance policy company will send you a look for the damages estimate minus the deductible. Nonetheless, you would certainly not have adequate funds to repair the damage to the lorry, which can dramatically lower its worth - cheapest.

You may have the ability to locate more information regarding this and also comparable material at (cheap car).

An Unbiased View of Understanding Your Insurance Deductibles - Iii

Insurance deductible specified An insurance deductible is the amount of cash that you are in charge of paying toward an insured loss. When a disaster strikes your house or you have an auto mishap, the insurance deductible is subtracted, or "deducted," from what your insurance coverage pays toward an insurance claim (risks). Deductibles are just how danger is shared in between you, the insurance holder, and your insurer.<</p>